In Chorley, Lancashire, UK, an 11-year-old spent $7,500 on in-app purchases on an iPad. In Canada, a 17-year-old spent $7,600 on packs in Fifa 16, using his dad’s credit card. Countless videos can be found on YouTube of kids stealing their parent’s credit card information in order to buy themselves in-game currency in games like Fortnite and Roblox. These “microtransactions gone wrong” stories go on and on, and they’ve gotten the attention of the US Federal Trade Commission.

In a congressional oversight hearing last week, FTC chairman Joe Simons said that the regulator was going to take a look at in-game loot boxes, following a letter sent to the Entertainment and Software Ratings Board (ESRB) by Sen. Maggie Hassan D-N.H. asking for an investigation into the practice.

“The prevalence of in-game microtransactions often referred to as ‘loot boxes’ raises several concerns surrounding the use of psychological principles and enticing mechanics that closely mirror those often found in casinos and games of chance,” Sen. Hassan said, in her letter.

She continued: “I also urge the board to examine whether the design and marketing approach to loot boxes in games geared towards children is being conducted in an ethical and transparent way that adequately protects the developing minds of young children from predatory practices.”

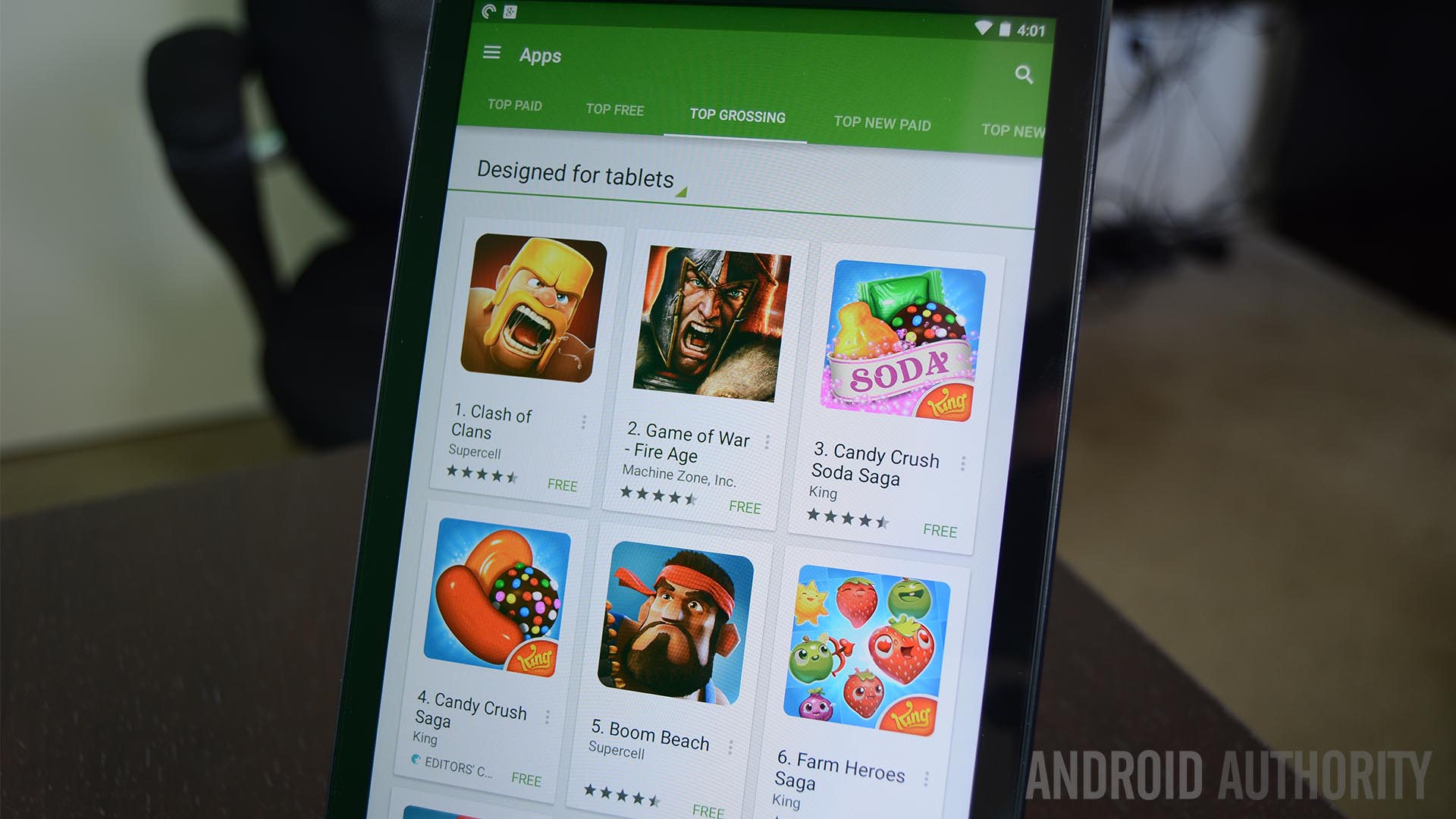

What are microtransactions and “loot boxes”? It’s when gamers spend real money in exchange for an in-game currency, which tend to cost anywhere between $0.99 and $99; the more money you spend, the more in-game currency you receive. According to Touro University, there are four types of microtransactions: in-game currencies, random chance purchases (like loot crates), in-game items, and expiration (encourages you to pay to keep playing). They aren’t a new concept either, but rather something that has become mainstream through smartphones and freemium games, like the app Clash of Clans.

Hassan isn’t the first person in government concerned about the predatory nature of microtransactions in video games. State Rep. Chris Lee, of Hawaii, is a known criticiser of Electronic Arts and their use of ‘loot boxes’ in their games.

“It’s clear that these mechanisms have the same kind of potential for cognitive harm for kids, and they have the same kind of addictive properties for those vulnerable to the same kind of thing [as gambling],” Lee said, in an interview with Polygon, “We’re not focused on regulating loot boxes because they’re gambling; we’re focused on protecting consumers from the same kind of harm that is posed by gambling.”

In February of this year, Lee’s state of Hawaii passed four laws, which prohibited the sale of games with loot boxes to anyone under the age of 21, regardless of the game’s rating, as well as required game publishers to label games that feature in-game purchases. Getting this to become a nationwide law, though, might take a little longer.

At the end 2017, only a few months before Sen. Hassan sent her letter, the ESRB denied there being a link between loot boxes and gambling. In an email to Kotaku, a spokesperson said that the “ESRB does not consider loot boxes to be gambling”.

“While there’s an element of chance in these mechanics, the player is always guaranteed to receive in-game content (even if the player unfortunately receives something they don’t want). We think of it as a similar principle to collective card games: sometimes you’ll open a pack and get a brand new holographic card you’ve had your eye on for a while. But other times, you’ll end up with a pack of cards you already have,” the email continued.

If ‘loot boxes’ aren’t gambling then, why are kids finding themselves spending so much on in-game customisation and currency, going as far as to steal their parent’s credit card to do so? Gabe Zimmerman, an expert of technology addiction, likens the tactics used by video game publishers that utilise loot boxes to those used at casinos; it’s called “operant conditioning”, or giving out the best prizes at random, so a pattern doesn’t exist.

“They’re all based on the same basic fundamental behaviour pattern: When people cannot predict how much they’re going to get, they often get very focused and fixated on it, and want to do it over and over again, past the point of rationality,” Zimmerman explained, according to DailyMail.

It might explain why children become so fixated on microtransactions, and will spend so much money without understanding the ramifications. To them, it’s just getting a cooler character customisation, or getting better weapons to use in-game. Plus, they are seeing countless videos of YouTubers opening and discussing ‘loot boxes’ in their videos. To older kids, and even adults, the fixation to spend money on in-game perks can become an addiction, and they’ll spend frivolous amounts of money on them.

Dr. Jamie Madigan, psychologist and author of ‘Getting Gamers: the psychology of video games and their impact on the people who play them’ explains why: “When you decouple the pain of spending money from the pleasure of getting the thing, people tend to spend more money. It sort of obfuscates how much money they’re spending.”

According to Kotaku, this was the case for one 19-year-old on Reddit, who goes by the username Kensgold, who discussed his gambling addiction in an open-letter to EA, following the publisher’s controversy with Star Wars Battlefront 2 microtransactions. According to an article by Kotaku, Kensgold found himself addicted to microtransactions, spending over $17,000 on in-game purchases, in games like Counter-Strike: Global Offensive, Smite, and The Hobbit: Kingdoms of Middle-Earth.

“The majority of the reason that I made my post was not really to slam EA or any of the companies that do this, but to share my story and to show that these transactions are not as innocent as they really appear. They can lead you down a path. It’s not like buying a stick of gum at the store,” Kensgold said.

Kensgold, though 19-years-old at the time the article was published, said “the lure of spending money for rewards” began at age 13. Most kids at 13 don’t have an income to support their spending of in-game/in-app purchases, which is why most parents wind up footing the bill, even if that bill is upwards of thousands of dollars. Unfortunately, there isn’t much parents can do.

Credit-card companies, according to Cracked.com, might be able to help under “zero liability protection”, but often they ask if the cardholder “exercised reasonable care in safeguarding your card from loss or theft”. On top of that, most credit-card companies say that the cardholder is only responsible for $50 of each unauthorised purchase, which doesn’t help if their child made small purchases that racked up a lot of money.

In addition to that, a lot of gaming companies have strict refund policies. Take Steam, for instance, which says refunds on games can only be made up to fourteen days after is was purchased, and only if the game has less than two hours of play on it. Epic Games, the company responsible for Fortnite, will only offer a refund on the last three purchases, if a request is made within 30 days.

So with parents struggling to get their money back, as kids become addicted to spending money on these in-game purchases, it makes sense why the FTC might want to start an investigation into the ‘loot box’ practices being adopted by video game companies. These tendencies can lead to gambling addictions later in life, and an investigation might be a blow to one of the most prosperous markets for video games, but a victory to protect children from predatory practices.